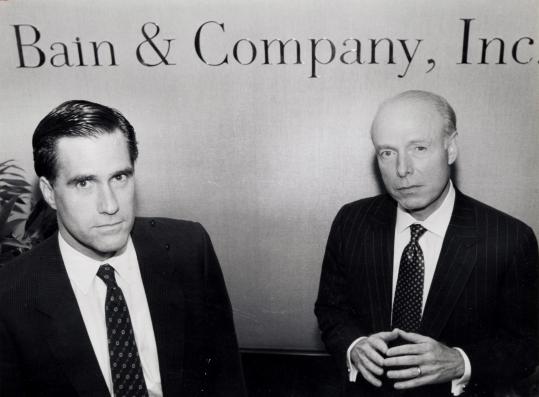

You may still think Mitt Romney is a “RINO” establishment villain, Save Jerseyans.

It’s your right to be wrong. I’ll fight to defend it!

But as of right now, he’s undeniably the most honest Republican with a national platform. He said something this week worthy of that lofty distinction; something we’ve all been thinking for a long, long time because is true:

httpv://www.youtube.com/watch?v=mQnxHBK6zMY

Did he say anything incorrect, Save Jerseyans?

Nope. He hit the nail directly on the head…

In modern America, the super rich and the very poor are the real “1%.” Anyone who has ever applied for college student aid knows this acutely. Ask any Rutgers-Camden Rowan University freshman. You’re better off being able to pay outright (rich) or not a damn thing (poor) when it’s time to register for pricey classes and even pricier text books; those who are just “rich” enough to go but not “poor” enough to qualify for aid (the middle class) are the ones who get screwed.

Like you. And me.

Of course, food stamp subsidies flow and corporate General Electric-style welfare persists in bad economic times. The middle class doesn’t have a choice to opt out of the franchise; it’s sink or swim… and pay taxes while desperately paddling to safety. Unlike GE.

The Washington-based Tax Foundation crunched the numbers back in ’04:

Overall, we find that America’s lowest-earning one-fifth of households received roughly $8.21 in government spending for each dollar of taxes paid in 2004. Households with middle-incomes received $1.30 per tax dollar, and America’s highest-earning households received $0.41. Government spending targeted at the lowest-earning 60 percent of U.S. households is larger than what they paid in federal, state and local taxes. In 2004, between $1.03 trillion and $1.53 trillion was redistributed downward from the two highest income quintiles to the three lowest income quintiles through government taxes and spending policy.

And that was 2004. Imagine what the numbers look like post-Obamacare.

Yet despite this massive spending discrepancy, the bottom 50% of U.S. income earners shoulder only 3% of the federal income tax burden. Many pay no federal income taxes at all. Conversely, while the super rich pay a huge amount of raw taxes, they can keep their taxable percentage down through accounting tricks and legitimate investing strategies that aren’t available to Jane and John Middleclass. Economic downturns effect them considerably more than the lifetime welfare recipients and John Kerrys of the world.

We can quibble over whether Mitt didn’t elaborate well enough. His chosen language could’ve been more precise. The truth remains: big government can’t create a single job but, in the hands of crony capitalists, it succeeds only in shielding the extreme ends of the socioeconomic pyramid from market forces.

So is it any surprise that the poorest AND richest districts in America are represented by liberal Democrats?

Again… nope.

Hence, Mitt Romney’s politically incorrect statement reflected political reality. All while other leading Republicans jet around the country trashing free market economics in favor of base populist pandering and hypocritical establishment-bashing.

Who’s the RINO now?

I discovered your blog website on google and check some of your early posts. Continue to keep up the very wonderful operate. I just extra up your RSS feed to my MSN News Reader. Looking for forward to reading much more from you later on!

cheap jordans