Poorly Researched Indictments of Reaganomics Won’t Change Obama’s Horrid Economic Record

By Matt Rooney | The Save Jersey Blog

Only days after I gave the NYT a little credit for calling out Bob Menendez, they’ve gone ahead and published a guest op-ed from Ramesh Ponnuru that nearly made my head explode. Here’s how it begins:

When Reagan cut rates for everyone, the top tax rate was 70 percent and the income tax was the biggest tax most people paid. Now neither of those things is true: For most of the last decade the top rate has been 35 percent, and the payroll tax is larger than the income tax for most people. Yet Republicans have treated the income tax as the same impediment to economic growth and middle-class millstone that it was in Reagan’s day. House Republicans have repeatedly voted to bring the top rate down still further, to 25 percent.

A Republican Party attentive to today’s problems rather than yesterday’s would work to lighten the burden of the payroll tax, not just the income tax. An expanded child tax credit that offset the burden of both taxes would be the kind of broad-based middle-class tax relief that Reagan delivered. Republicans should make room for this idea in their budgets, even if it means giving up on the idea of a 25 percent top tax rate.”

The problem with Ponnuru’s math is that it’s not really math, folks.

It’s a horribly inaccurate recollection of America’s recent tax history…

Yes, the top income tax bracket rate was 70% in 1980… the last full year before Ronald Reagan took office and at the onset of a bad recession with 7.5% national unemployment and rising. But even with a 70% top marginal tax rate, the top 1% of federal income taxpayers accounted for only 19% of total federal income tax revenue. Now the top 1% pay nearly 40%.

That’s a more than 200% increase! All despite the fact that the top rate as of 2012 was 35%, or half of what it was is 1980 when the Gipper beat Jimmy Carter. And what did Reagan do upon taking office? He saw to it that the top tax rate dropped to 50% for 1982, the same year that unemployment peaked at 10.8%.

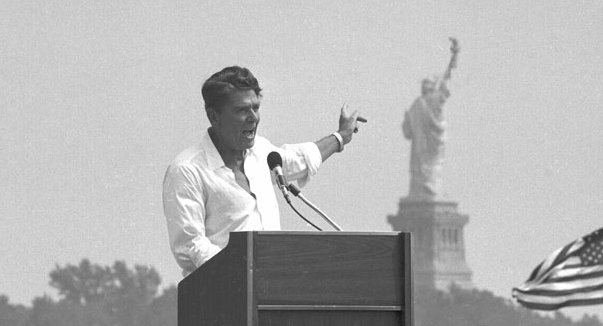

The proof is in the pudding. Unemployment and inflation subsequently began a long decline and corporate earnings jumped 29% in the 3rd quarter of 1983. By the time President Reagan began his second term, unemployment was down 0.2% from where it was when he initially took office, and the U.S. economy created over 1 millions jobs per month! Then Reagan successfully pushed to have the top rate dropped to 38.5% in 1987 and 28% in 1988. He left office with a 5.4% unemployment rate.

Reagan’s tax legacy paid off for an entire generation. Except for two mild, brief recessions in the early 1990s and early 2000s respectively, the American people enjoyed the longest peacetime economic expansion in U.S. history (until the subprime mortgage crisis tanked our economy in 2008) with a consistent top tax rate more than 30-points lower than when Ronald Reagan went to Washington.

Do you need any more proof that President Obama’s policies (still) aren’t working, Save Jerseyans?

Facts are stubborn things. Don’t let the liberal mainstream media get away with changing the subject to mask their candidate’s pathetic performance!