By Jordan T. Chester

Save Jerseyans: there are a host of reasons why you and your legislators should oppose the gas tax “compromise” passed by the State Assembly and now stalled in the Senate.

This “compromise” would be harmful to our state’s economy, those who are living paycheck to paycheck, it would harm our tourism industry, and it would increase the cost of shipping goods and thus, consumer prices would increase. I could go on and on about how bad this deal really is…..

Instead, I have come up with a list of the top fifteen reasons this gas tax scheme is atrocious:

-

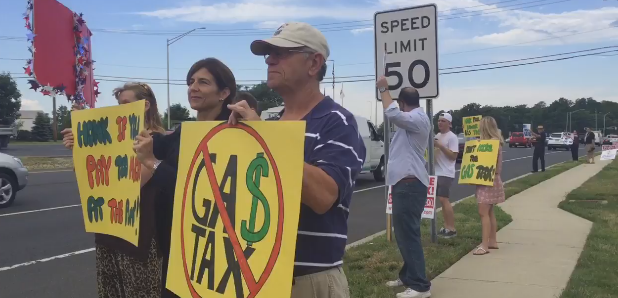

State Senator Jen Beck (R-Monmouth) rallies LD11 residents against the gas tax hike. This deal would increase a regressive tax while reducing a progressive tax. While a sales tax is usually regressive, that is not the case in New Jersey since we exempt food and clothing from taxation. Those of us who are in middle or lower income tax brackets are more likely to drive vehicles with poorer fuel economy. While I don’t support the idea of increasing taxes on the wealthy for some flawed notion of fairness, I also oppose the concept of giving a tax cut to the wealthy at the expense of everyone else.

- People can buy fewer luxury items subject to the sales tax, but the gas tax is required for people to get to work. Taxing gasoline more cuts into take-home pay and discourages work, thus encouraging a culture of dependency on government.

- A gasoline tax hike will increase the cost of trucking and therefore, the cost of consumer goods will increase.

- If the next Governor decides he/she opposes the sales tax cut included in this deal, the sales tax cut may be reversed since it won’t go into full effect until 2018.

- This tax plan is not revenue neutral – Trenton will lose revenue which would not be a bad thing if they cut spending, but history shows us they would either increase taxes or not meet obligations. This is an $850 million tax increase.

- The gas tax is the one tax where we don’t tax as much as other states.

- Trenton has dedicated revenue streams to programs over the years and somehow, we always seem to end up in a situation like the one we are in.

- Our $40 billion per year tourism industry would be disrupted by this tax hike. Without our tourism industry, every household in New Jersey would pay over $1,400 in higher taxes.

There are over 6.1 million licensed drivers in New Jersey – this IS a broad-based tax increase.

There are over 6.1 million licensed drivers in New Jersey – this IS a broad-based tax increase.

- There are other areas to cut – start with the $6 billion in corporate subsidies we’ve handed out this decade and continue with meaningful pension & benefit reform.

- As a friend pointed out to me, businesses are going to have to change their pricing processes and software which will cost them money as the sales tax is gradually changed over the next two years.

- The process by which we have this deal is unacceptable – the days of midnight deals should be over.

- Jim McGrevey’s $8 billion in tax & fee increases caused $70 billion in wealth to leave our state in the years after he implemented those policies, we should not repeat the mistakes of the past.

- According to Rutgers/Eagleton, 56% of New Jerseyans oppose increasing the gasoline tax.

- We should audit the Department of Transportation and find out why we spend $2 million per mile on road repairs before we ask residents for higher taxes.

There are more reasons why this legislation is a raw deal, but here are fifteen you should relay to your elected representatives!

____