Save Jerseyans, as a student and a local elected official, I thought it was necessary to weigh in on the gas tax talk this week:

We aren’t the first state that’s been thrown under the gas tax bus.

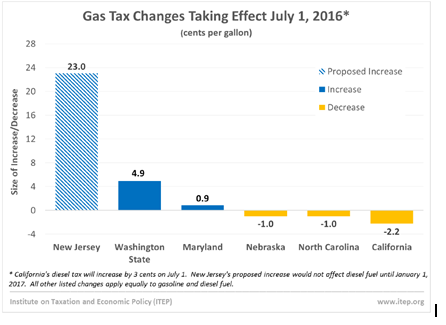

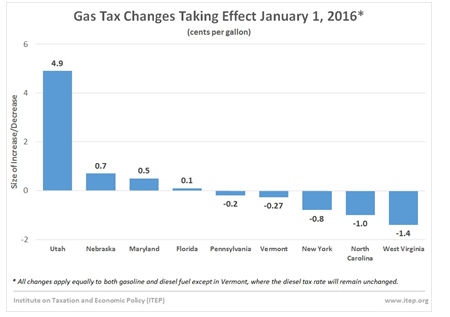

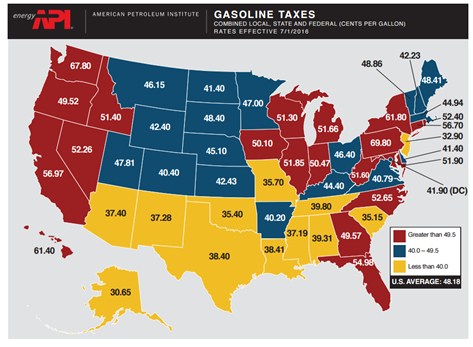

The federal government’s inaction of raising the gasoline tax has resulted in many states raising their tax for transportation revenues. Washington phased in a 11.9 cent increase over a few years to fund their transportation projects. Florida, Maryland, and Utah drivers have incremental increases based on inflation and fuel prices, while California’s falling gas tax revenues has led to a cut in $754 million transit project funding over the next 5 years. California drivers already overpay their gas taxes with their hidden gas tax, the state’s cap and trade program:

It appears Save Jerseyans, not only are we late to the party, but we’re the worst kind of late. Decades late; 26 years frozen in time. We’ve talked about kicking the can down the road; but we won’t even have a road to kick the can down. We won’t keep pace with the rate of growth in the cost of infrastructure maintenance and construction for the next generation. Even if the tax is enacted, the state will likely continue to dip into the general funds to fund large capital transportation projects to repair and rehabilitate crippling state bridges and roads.

But wait, it gets worse. Studies show that the state gasoline tax is more regressive than the federal gasoline tax. Yes, read that again.

The federal tax is a more stable, elastic tax, and less regressive; meaning, the burden of the tax tends to fall evenly on consumers and producers in the market over the long-run. Simulated federal tax increases have a wide variety of conclusions showing reduced consumption, increase in labor supply, decline in leisure driving, increased carpooling, more use of mass transit, and even in one case, at least 7.5 million hours a year of time saved for consumers. All of these conclusions of the federal tax go beyond the initial prediction of environmental benefits and corrected externalities. However, that tax has been frozen since 1994, and we’re dealing with the state tax, which has different economic results.

In one state tax study, a one cent increase in the gasoline tax led to a $1.01 increase in the price paid by consumers and a 0.02 cent increase in the price received by producers (Chouinard and Perloff 2004). One cent. Additionally, if a state does raise it, producers tend to shift gasoline to the lowered tax states surrounding it. Even if you get can passed the increased prices on both consumers and producers, how about the revenues?

The Institution on Taxation and Economic Policy found that states are collectively losing about $10 billion per year due to construction cost increases that have occurred since the last time their gas tax rates were raised. Their report titled “Building a Better Gas Tax” also explained that both federal and state taxes have seen the real value of the rates fall by 41 percent.[1]

Proponents of the tax tend to point to the deal on the table: the $2 billion fund over 8 years, cut to the sales tax, the phasing out of the estate tax, and offering veterans and low-income residents tax credits. Yet they neglect the large budget shortfall that will exist and the fact that $2 billion won’t cover the 222 projects stalled for this year alone.

To Democrats reading this: The deal isn’t looking to reduce environmental problems like congestion or local air pollution, reduce the deficit, or fund research for fuel dependency. It’s not encouraging fuel-efficiency, increasing energy security, or preventing climate change. If the goal of a tax is to maximize benefits of scarce resources, then each tax dollar collected would be returned back in a dollar environmental value or a dollar in revenue.

Past misuse and abuse of revenues for pet projects and neglect for other programs should give us an idea of how these funds will be allocated. The consequences of a state tax like this are not to be understated.

Bottom line Save Jerseyans, this so-called “deal” is not a deal for the majority of New Jersey’s residents. It puts an unfair burden on middle class families in New Jersey and will undoubtedly increase the price of goods and services for everyone:

_____

[1] Institution on Taxation and Economy Policy. December 2011. “Building a Better Gas Tax: How to Fix One of State Government’s Least Sustainable Revenue Sources.” <http://www.itep.org/bettergastax/bettergastax.pdf> (April 23, 2014).

_____