For years, state legislators in both political parties have told us they’d fight for policies aimed at reducing property taxes. While state government doesn’t directly levy property taxes, much of what is done in Trenton has a large impact on the rate of county and municipal taxes.

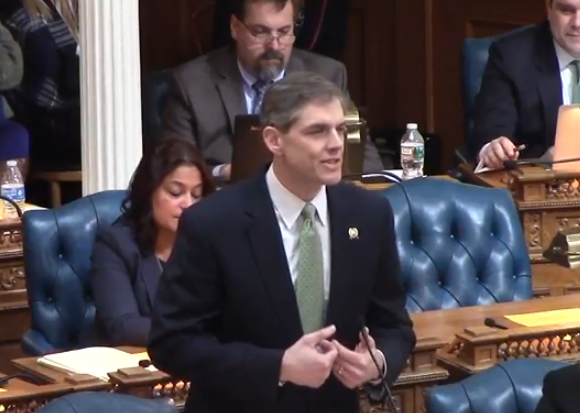

My friend Assemblyman Jay Webber (R-26) has courageously opposed tax increases and those policies that would lead to higher property taxes. Additionally, he’s proposed policies that would make our state more affordable for individuals and businesses. Right now, Assemblyman Webber is sponsoring a bipartisan bill (A-302) that would provide direct property tax relief using funds the state collects from utility companies.

Each year, state government collects monies from utility companies for their use of public infrastructure. This money is then deposited into a fund for property tax relief, known as the Energy Tax Receipts Property Tax Relief Fund. However, Trenton politicians have used the money in this fund to balance the budget as required by the state constitution. Assemblyman Webber’s legislation would ensure that the Energy Tax Receipts Property Tax Relief Fund is used for its intended purpose by providing $330 million of property tax relief for homeowners and businesses that own property.

The reality is that the primary driver of property taxes in New Jersey is the current school funding formula. While we shouldn’t give up on enacting school funding reform that provides direct property tax relief, there are other pieces of legislation such as Assemblyman Webber’s that would go a long way towards the overall goal of making New Jersey more affordable.

The reality is that the primary driver of property taxes in New Jersey is the current school funding formula. While we shouldn’t give up on enacting school funding reform that provides direct property tax relief, there are other pieces of legislation such as Assemblyman Webber’s that would go a long way towards the overall goal of making New Jersey more affordable.

Passage of this particular legislation is important for a few reasons.

First, there are millions of people in our state struggling to make ends meet due to the high cost of living here and any relief is welcome. Data from United Way shows that 38% of garden state residents are either struggling financially despite having regular income or in poverty.

Secondly, there is a principle involved here. Public infrastructure doesn’t belong to the government; it belongs to the public. Therefore, the public should reap the benefits of their property being used by utility companies.

Third, the Energy Tax Receipts Property Tax Relief Fund should not be used by politicians to balance the state budget without having to make hard choices on spending.

I urge everyone to email, write, or call your legislators and tell them to support Assemblyman Webber’s legislation, A-302, so we can finally see real property tax relief.

–