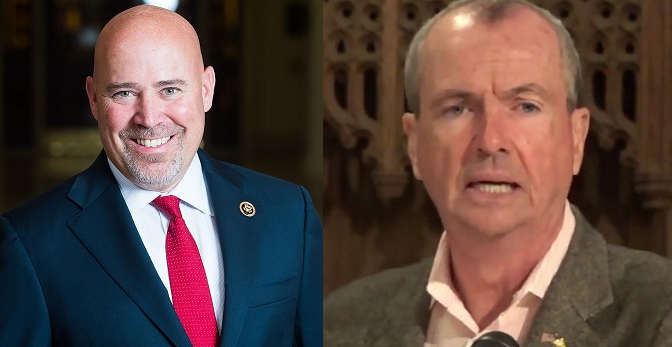

WASHINGTON, D.C. – Congressman Tom MacArthur (R, NJ-03) is New Jersey only official in high-elected office who’s unapologetically supporting the national GOP’s tax reform push, squaring off directly with Governor-elect Phil Murphy in the media and openly challenging critics to put up or shut up on tax relief.

On Monday? MacArthur penned and released a responsive letter directed at the Governor-Elect and Senators Menendez and Booker after all three men attacked MacArthur in the press over his support for the tax reform push expected to benefit the vast majority of New Jersey taxpayers.

“I invite you to come explain to the middle-class family in Toms River, who would see a $1,000 tax cut, why you believe the government deserves their money more than they do,” MacArthur’s letter (posted below) states. “You criticize Republicans for fear-mongering, divisiveness, and spreading mistruths, yet you are engaging in the same exact behavior as it relates to tax reform. It’s not right when Republicans do it, and it’s not right when you do it either.”

The New Jersey Democrat establishment’s hypocrisy on the issue of tax reform — and New Jersey’s property tax crisis which makes the SALT deduction such a big deal in the place — is glaring.

Back in 1996, New Jersey’s legislature voted to reinstate the state property tax deduction under the gross income tax. That bill (S1) limited the total deduction to 50% of $5,000 in year one, 75% of $7,500 in year two, and then finally up to 100% of $10,000 in year three. Twelve Democrats currently in the legislature voted for S-1: Lesniak, Rice, Sacco, Cruz-Perez, Gill, Greenwald, Green, Gusciora, Smith, Turner, Weinberg, and Wisniewski. Another — Bill Pascrell — has since been promoted to Congress but voted YEA back in 1996 when he was still a state legislator.

The current MacArthur-backed tax reform package would allow New Jersey taxpayers to deduct the same amount on their federal taxes as permitted on their New Jersey state taxes.

All the same, the entire New Jersey Democrat establishment is remaining silent on the elimination of the state cap even after one legislator — Joe Pennacchio of Morris County — proposed such a measure this month.

__

December 11, 2017

Dear Governor-Elect Murphy, Senator Menendez, and Senator Booker,

Instead of working to deliver real tax relief to New Jerseyans who deserve it, you have all decided to embark on a dishonest campaign intended to mischaracterize the tax reform legislation working its way through Congress for partisan political gain.

Our shared constituents deserve better. They deserve the truth.

New Jersey is among the highest-taxed states in the nation and a recent study ranked us as the worst state in America for out-migration. Retirees, millennials and families are leaving New Jersey in droves because they can’t afford to stay. That crisis has zero to do with a federal tax reform bill that hasn’t become law yet.

Worse, it has become abundantly clear that you have not done any real analysis of this plan, outside of parroting partisan talking points. So, allow me to educate you about why the Tax Cuts and Jobs Act is good for the constituents of New Jersey’s Third Congressional District.

Right off the bat, more than half of my constituents take the standard deduction, which doubles in the legislation I supported. Nearly 70% of taxpayers across the country use the standard deduction, while high-income earners are more likely to itemize.

Furthermore, the median family with two kids in NJ-03 makes $110,620. Under current law, this family pays $7,469.94. Under the House bill, they’d pay $6,460.26 – a tax cut of $1,000. This doesn’t even include the other benefits they may experience if they run or work at a small business, or if they work at a company that will now invest more in the New Jersey instead of overseas.

Here are some other benefits of this bill:

– An increase in the child tax credit. Over 48,000 families in my district currently claim the child tax credit. Under this legislation, each of these families would receive an additional $600 per child, plus more families would be eligible for this credit.

– The creation of a non-child dependent tax credit. This would provide families who are caring for an elderly parent with more money in their pocket.

– Giving small businesses the lowest tax rate since World War II, which will help Main Street businesses from Toms River to Willingboro.

– Lower tax rates, which will enable our shared constituents to keep more of their hard-earned money.

As for the $10,000 property tax deduction, months ago some in my own party wanted to eliminate it entirely. Instead of bloviating in press releases and grandstanding at press conferences, I negotiated with The White House and House Leadership, and successfully restored the property tax deduction, which will benefit all New Jersey property owners to the tune of $3.6 billion per year.

I find it interesting that you oppose my efforts, yet New Jersey has the same cap and I haven’t heard any of you say a word about changing it.

My district voted for Barack Obama in 2012, Donald Trump in 2016, and Kim Guadagno in 2017. Donald Trump won Ocean County by 90,000 votes, while Hillary Clinton won Burlington County. Despite its “swing district” status, I have won two races by double digit margins here because I consistently work across the aisle to fix the tough problems facing our nation. The Lugar Center ranked me among the top 15% most bipartisan Members of Congress, while Senators Menendez and Booker are found in the bottom third.

So, when Barack Obama had a plan in place to close military bases like Joint Base McGuire-Dix-Lakehurst, which would have devastated our economy and military readiness, I stood up and won for South Jersey. When Donald Trump proposed major budget cuts to the Office of National Drug Control Policy, which would have hurt our efforts to combat addiction, I stood up and won for South Jersey.

I invite you to come explain to the middle-class family in Toms River, who would see a $1,000 tax cut, why you believe the government deserves their money more than they do. You criticize Republicans for fear-mongering, divisiveness, and spreading mistruths, yet you are engaging in the same exact behavior as it relates to tax reform. It’s not right when Republicans do it, and it’s not right when you do it either.

Sincerely,

Tom MacArthur

–