By Brian Thomas

_

In an expected move by Governor Phil Murphy, New Jersey has filed a joint lawsuit against the U.S. Department of Treasury & IRS in an attempt to impede a tax policy change implementing a $10,000 State and Local Tax (SALT) deduction cap on federal income taxes as part of the “Tax Cuts & Jobs Act of 2017 (TCJA).“

New Jersey Attorney General Gurbir Grewal joined co-plaintiffs from New York, Maryland, & Connecticut in seeking an immediate injunction to the tax law on the grounds that it is “unconstitutional,” violating both the 14th Amendment’s “Equal Protection Clause” as well as the protection of states’ rights under the 10th Amendment.

–

The Legal Argument:

The suit claims the Trump Administration was politically motivated, seeking to negatively impact certain high taxed-Democrat governed states.

The plaintiffs argue that both the Department of Treasury & IRS operated under this assumption establishing

“[T]he federal government went after these states deliberately…the point of the changes to the SALT deduction was to ‘send a message to the state governments’ that Washington wants them to change their spending policies.”

The plaintiffs are also citing what they believe is 150 years of precedent to solidify standing in that a SALT deduction has been part of federal income taxes since 1861 & is a critical component of ensuring a state’s right to govern.

–

How does this impact property taxes?

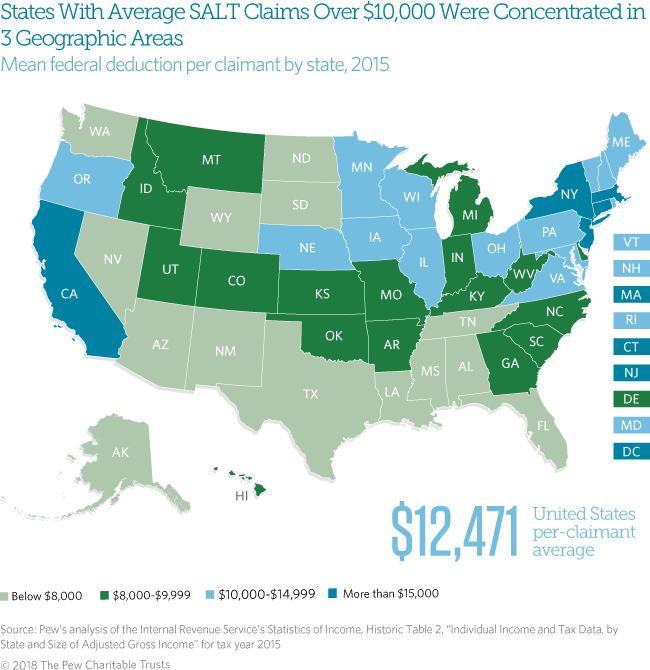

Over 41% of New Jersey residents use SALT with the average deductions between $17,000 & $18,000 – the vast majority of which come from property taxes.

With the average residential property tax bill of $8,690, New Jersey residents are near if not over the new $10,000 SALT cap limit before including additional tax deductions.

–

If NJ wins, does this lower property taxes?

In short, no. The overall amount you owe each year will not lessen, this only affects the deduction amount on your federal income taxes. This is separate from the main underlining issue impacting NJ’s taxpayers, affordability.

Regardless of the outcome of this case, residents still face excessive property taxes which increase year after year. If the current system was adjusted by elected officials in a way to alleviate tax burdens then there would be less of a necessity for a lawsuit that will take months, if not years to play-out.

As the case proceeds we will keep residents up-to-date on any new developments.

___

Brian Thomas is Executive Director of Citizens for Accountable Taxation, Inc.

–