By Matt Rooney | The Save Jersey Blog

A New Jersey legislator is calling for a more immediate and thorough investigation into the Internal Revenue Service (IRS) and its targeting of conservative group and individuals.

A New Jersey legislator is calling for a more immediate and thorough investigation into the Internal Revenue Service (IRS) and its targeting of conservative group and individuals.

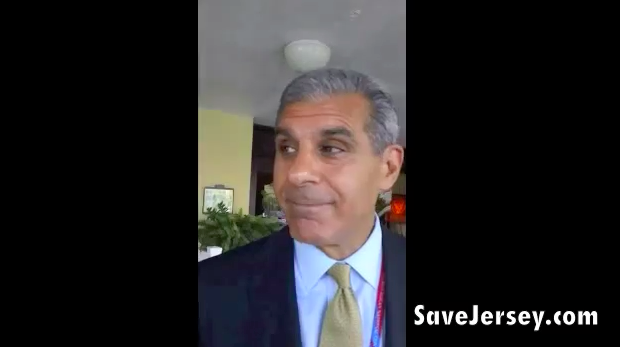

State Sen. Joe Kyrillos (R-Monmouth) today accused the IRS of “political spying” and introduced a resolution urgins those with oversight responsibilities to “reveal everyone involved so that they can be held accountable.”

Congress wasn’t in session this week but staffers are reportedly busy preparing for a fresh round of hearings. Kyrillos, for his part, is facing a Republican Primary fight on Tuesday from Lee Ann Bellew and a Tea Party-backed ticket; he undoubtedly hopes base voters appreciate his modest attempt to help keep the story churning.

The text of Sen. Kyrillos’s resolution is below the fold…

A Senate Resolution condemning the Internal Revenue Service’s review of certain organizations applying for tax-exempt status and urging Congress and the President to take appropriate action to restore the public’s trust in the federal agency.

Whereas, the federal Treasury Inspector General for Tax Administration recently released a report that found that beginning in 2010 the federal Internal Revenue Service used inappropriate criteria to identify for review Tea Party and other organizations applying for tax-exempt status based on the names or policy positions of the organizations instead of indications of potential political campaign intervention; and

Whereas, the report found that inefficient management by the Internal Revenue Service allowed inappropriate criteria to be developed and remain in place for more than 18 months, resulted in substantial delays in processing applications, and allowed unnecessary information requests to be issued to certain organizations applying for tax-exempt status; and

Whereas, following the release of the report the Internal Revenue Service acknowledged publicly that organizations that included the words “tea party” or “patriot” in their applications for tax-exempt status were singled out for additional reviews, the acting commissioner and certain other high-level employees of the agency have resigned, and the former acting commissioner apologized in testimony before Congress for the mistakes that were made and the poor service that was provided by the agency; and

Whereas, these actions demonstrate that the Internal Revenue Service is aware of the seriousness of its wrongdoings and the need to implement corrective actions to improve the conduct and management of the process through which the agency identifies and reviews applicants for tax-exempt status; but

Whereas, a number of important questions remain, including: who knew about the inappropriate criteria used to identify for review Tea Party and other organizations applying for tax-exempt status, when those individuals who knew first became aware of the use of the inappropriate criteria, and if concerted efforts were made by individuals employed by the Internal Revenue Service or by others in the President’s administration to cover up the agency’s actions; and

Whereas, without further investigation to resolve these remaining questions, public distrust of the Internal Revenue Service will continue to grow and impede the agency from acting as impartial arbiter in deciding whether organizations merit tax-exempt status and, more generally, from fulfilling its core mission to help taxpayers understand and meet their tax responsibilities and to apply the tax law with integrity and fairness to all; now, therefore,

Be It Resolved by the Senate of the State of New Jersey:

1. This House condemns the federal Internal Revenue Service’s use of inappropriate criteria to identify for review Tea Party and other organizations applying for tax-exempt status, and calls on Congress and the federal Department of Justice to continue its investigation of the matter to the fullest extent permitted under the law.

2. This House urges Congress and the President of the United States to take all actions necessary to ensure that the Internal Revenue Service implements corrective actions to improve the conduct and management of the process through which the agency identifies and reviews applicants for tax-exempt status, that the individuals responsible for the wrongdoings are held accountable, and that the public’s trust in the agency is fully restored.

3. Duly authenticated copies of this resolution, signed by the President of the Senate and attested by the Secretary thereof, shall be transmitted to the President of the United States, the Majority and Minority Leaders of the United States Senate, the Speaker and Minority Leader of the United States House of Representatives, each member of Congress who is elected from this State, and the acting commissioner of the Internal Revenue Service.

STATEMENT

This resolution condemns the federal Internal Revenue Service’s use of inappropriate criteria in identifying for review certain conservative organizations that applied for federal tax-exempt status, and urges Congress and the President of the United States to take appropriate action to restore the public’s trust in the federal agency.

On May 14, 2013, the federal Treasury Inspector General for Tax Administration released a report that found that beginning in 2010 the Internal Revenue Service used inappropriate criteria to identify for review Tea Party and other organizations applying for tax-exempt status based on the names or policy positions of the organizations instead of indications of potential political campaign intervention. The report found that inefficient management by the agency allowed inappropriate criteria to be developed and remain in place for more than 18 months, resulted in substantial delays in processing applications, and allowed unnecessary information requests to be issued to certain organizations applying for tax-exempt status.

The Internal Revenue Service has since acknowledged publicly that organizations that included the words “tea party” or “patriot” in their applications for tax-exempt status were singled out for additional reviews. This acknowledgement together with public concern over the conduct of the federal agency has led to the resignation of the acting commissioner and certain other high-level employees of the agency.

Despite these developments, a number of important questions remain. It is unclear who knew about the inappropriate criteria used to identify for review Tea Party and other organizations applying for tax-exempt status, when those individuals who knew first became aware of the use of the inappropriate criteria, and if concerted efforts were made by individuals employed by the Internal Revenue Service or by others in the President’s administration to cover up the agency’s actions.

This resolution condemns the federal Internal Revenue Service’s use of inappropriate criteria to identify for review Tea Party and other organizations applying for tax-exempt status, and calls on Congress and the federal Department of Justice to answer the questions that remain by continuing to investigate the matter to the fullest extent permitted under the law. The resolution urges Congress and the President to take all actions necessary to ensure that the Internal Revenue Service implements corrective actions to improve the conduct and management of the process through which the agency identifies and reviews applicants for tax-exempt status, that the individuals responsible for the wrongdoings are held accountable, and that the public’s trust in the federal agency is fully restored.

The time has come to eliminate all 501-c-3 organizations that masquerade as "social welfare" groups and enjoy a tax-exempt status while they are really engaging in partisan political activity. The dreadful Citizens United decision has allowed millions of dollars of anonymous donations to flow to various Tea Party groups, one of which I believe co-sponsored a GOP Presidential debate. And no Tea Party group was ever denied tax-exempt status.