Senate President Stephen Sweeney (D-Machineland) recently held a “town hall” meeting of his own, Save Jerseyans. Not nearly as exciting as Christie’s but hey, everyone needs to start somewhere.

His goal? To push an alternative tax cut plan to Governor Christie’s 10% across-the-board proposal.

The problem? Sweeney’s stunning lack of basic economic knowledge!

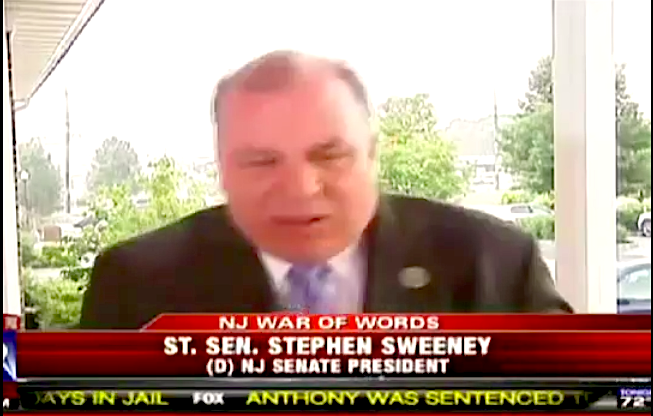

Watch this brief clip from the Senate Dems. At one point, Sweeney makes some very general claims about wealthy Americans’ spend habits in a recession which, quite frankly, he must’ve invented on the spot or pulled out of crib notes borrowed from Lou Greenwald:

httpv://www.youtube.com/watch?v=YGe4HfyxhW8

The rich save disproportionately during recessions? More than their lower-income neighbors? Since when?! Sure, they’re clipping coupons just like the rest of us. Most of them didn’t get rich without accruing a little fiscal responsibility! Nevertheless, experts have consistently observed comparatively high spending by wealthy citizens throughout this never-ending economic downturn [via AdvertisingAge (2009)]:

Bob Shullman, president of Ipsos Mendelsohn, prefers a glass-full approach, noting that the vast majority of the affluent are still planning to buy big-ticket items. […]

Despite pullbacks on spending plans in many big-ticket categories, the number of affluent individuals planning to marry, get engaged, have children or retire remained unchanged from 2008 to 2009. It takes more than a recession — something more like the Great Depression — to change those numbers, Mr. Shullman said.

Forbes printed similar findings around the same time and recent data remains consistent. There IS, however, one area where experts have observed significantly reduced spending among the so-called “rich” folks in lean times:

The number of affluent households in which someone plans to start a business, however, dropped around 24% to 1.7 million in 2009 from 2008. There are other numbers that aren’t pretty — and arguably fewer of the affluent will be as well — what with a 40% decline in the number planning cosmetic surgery this year compared to last, down to around 600,000.

It doesn’t take a rocket scientist to fill in the blanks, folks. Lowering the tax burden on high-earning businessmen and women can generate business investment, i.e. new employees, equipment upgrades, plant expansions, etc. That’s a net positive for everyone regardless of his or her income level.

On an individual level, a worker living paycheck-to-paycheck receiving a $500.00 income tax refund will typically pay off a credit card bill with their windfall. A wealthy individual receiving $5,000.00 from the same tax cut will save part of it, sure, but they’re also likely to spend a portion on something good for our economy like a vacation or a portable good.

Senator Sweeney should stick to the facts and quit inventing facts to fit his party’s narrative. We’d all be better off for it.

We all must remember where Sweeney received his degree in economics …Match-book cover U