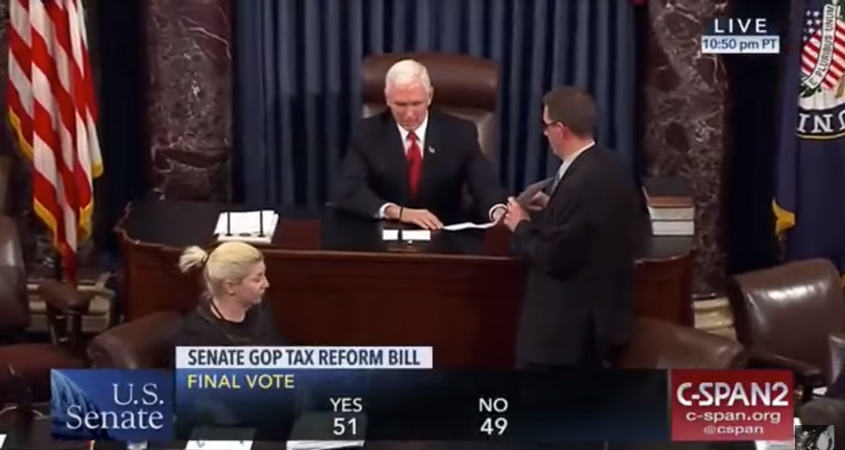

It was frequently in doubt, Save Jerseyans, but in the early hours of Saturday morning, the U.S. Senate passed the biggest overhaul of the U.S. tax code since the 1980s.

“I think this bill is terrific for America and for New Jersey,” said Rep. Tom MacArthur, the tax reform effort’s sole New Jersey legislative champion, on the eve of the vote. Senator Susan Collins (R-ME) announced the same day that the Senate would retain the House legislation’s $10,000 SALT deduction, a popular item in property tax-battered New Jersey and other high-cost “blue” states. New Jersey’s mean bill hit $8,549 in 2016,

Other key provisions include major tax cuts for businesses intended to spur growth, the elimination of many deductions for those who itemize as an attempt to simplify the tax code, and a major expansion in the standard deduction — relied upon by the vast majority of Americans — to $12,000 for individuals and $24,000 for couples. The per-child tax credit will also increase.

President Trump took to Twitter and expressed his determination to sign the final product before Christmas:

We are one step closer to delivering MASSIVE tax cuts for working families across America. Special thanks to @SenateMajLdr Mitch McConnell and Chairman @SenOrrinHatch for shepherding our bill through the Senate. Look forward to signing a final bill before Christmas! pic.twitter.com/gmWTny3SfS

— Donald J. Trump (@realDonaldTrump) December 2, 2017

Biggest Tax Bill and Tax Cuts in history just passed in the Senate. Now these great Republicans will be going for final passage. Thank you to House and Senate Republicans for your hard work and commitment!

— Donald J. Trump (@realDonaldTrump) December 2, 2017

“Thanks to Republican leadership, we are one step closer to delivering historic tax reform for the American people,” said RNC Chairwoman Ronna McDaniel following the Senate vote. “President Trump and Republican leaders in Congress made a pledge to expand economic opportunity for all, cut taxes for the middle class and small business owners—and tonight, they kept their promise. This legislation will spur growth, strengthen our economy, and empower American businesses to create more American jobs, and I am confident tonight’s vote will continue the process of making America great again.”

–