Those giving into the hysteria and rushing to prepay their 2018 property taxes may want to talk to a tax professional before making another move.

There’s now doubt as to how – if at all – doing so will benefit New Jersey property taxpayers.

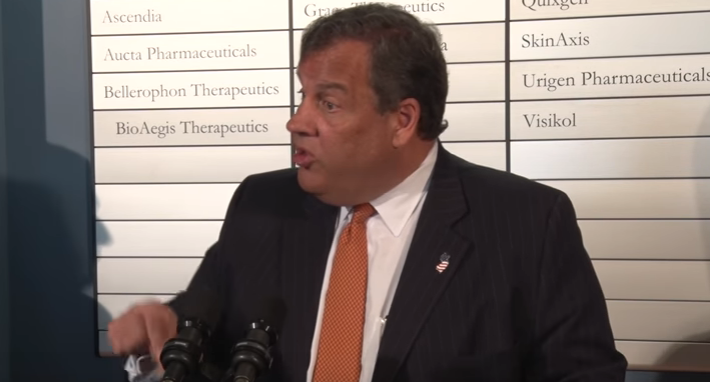

On Wednesday, shortly after New Jersey Governor Chris Christie issued an executive order requiring municipalities to accept property tax prepayments, the IRS issued a statement which possibly contradicts the premise of Christie’s decision, declaring that prepayments of anticipated property taxes (not assessed and paid before 2018) will not be deemed deductible in 2017.

“The IRS has received a number of questions from the tax community concerning the deductibility of prepaid real property taxes,” the IRS explained. “In general, whether a taxpayer is allowed a deduction for the prepayment of state or local real property taxes in 2017 depends on whether the taxpayer makes the payment in 2017 and the real property taxes are assessed prior to 2018. A prepayment of anticipated real property taxes that have not been assessed prior to 2018 are not deductible in 2017. State or local law determines whether and when a property tax is assessed, which is generally when the taxpayer becomes liable for the property tax imposed.”

This “clarification” may only add to the confusion for property taxpayers curious as to how the new law will impact their tax burdens for 2017, 2018 and beyond.

Christie’s executive order directed towns to accept prepayments BUT the order doesn’t address assessment timelines. A reading of the IRS statement suggests taxpayers in towns where the first two quarters have already been assessed may benefit from prepaying those two quarters. Only an accountant can tell him or her for sure based upon the taxpayer’s individual circumstances (e.g. in some cases, these prepayments could trigger AMT problems).

Concerning those prepaying for the entire year? And not just the first two assessed quarters? The IRS is indicating that those second two quarters’ worth of prepayments for ANTICIPATED levies won’t count for 2017 as some have been led to believe by N.J. officials. The IRS provided an example in its statement…

Example 2: County B also assesses and bills its residents for property taxes on July 1, 2017, for the period July 1, 2017 – June 30, 2018. County B intends to make the usual assessment in July 2018 for the period July 1, 2018 – June 30, 2019. However, because county residents wish to prepay their 2018-2019 property taxes in 2017, County B has revised its computer systems to accept prepayment of property taxes for the 2018-2019 property tax year. Taxpayers who prepay their 2018-2019 property taxes in 2017 will not be allowed to deduct the prepayment on their federal tax returns because the county will not assess the property tax for the 2018-2019 tax year until July 1, 2018.

Click here to view the full statement and, of course, TALK TO YOUR CPA before making major (and potentially expensive) decisions!

–