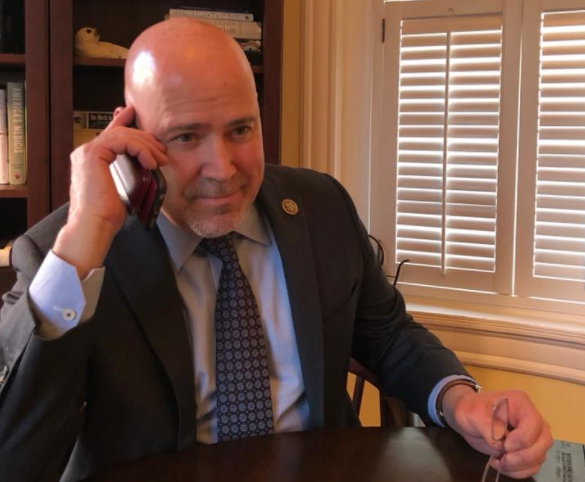

WASHINGTON, D.C. — Congressman Tom MacArthur (R, NJ-03) joined a majority of his colleagues on Friday by voting to make the recent historic federal tax cut package permanent for individual and small-businesses throughout the country including MacArthur’s South Jersey district.

“Making the federal tax cuts permanent is good for New Jersey families, small businesses, and the economy. New Jerseyans and the nation are already seeing the results of reducing the federal tax burden. On average, New Jersey taxpayers will see a federal tax cut of nearly $1,500 in 2018; more than half of our state’s taxpayers will see a reduction of $2,740. That is real money making a real difference in the lives of New Jersey families,” said Congressman MacArthur in a statement. “Americans continue to benefit from a thriving economy—small business optimism is at its highest level ever recorded, consumer confidence is rising, and Americans are seeing increased bonuses, higher wages, and more employee benefits because of the Tax Cuts and Jobs Act. Right here in Toms River, OceanFirst Financial Corp. raised its minimum wage to $15 per hour because of the newly lowered corporate tax rate.”

The new legislation included language to extend the original package’s popular child care and medical expense changes, providing families with children or large medical bills extra relief.

“At the beginning of the tax reform process, I worked with the White House and House and Senate leadership to make the bill better for New Jerseyans. I fought for our South Jersey seniors and those with high medical costs, and we expanded the medical expense deduction,” added MacArthur. “The state and local tax deduction was slated to be zero, but I successfully preserved the deduction. Recent analysis of the SALT deduction cap found that if the cap was eliminated, it would benefit New Jersey’s richest 1.5% and hurt the middle-class. Keeping the SALT deduction cap at $10,000 is in line with New Jersey state law and covers nearly every taxpayer in Burlington and Ocean Counties.”

MacArthur was the only incumbent N.J. GOP congressman to support the original legislation which has generated major dividends for the U.S. economy; wages are now growing at the fasted pace in 9 years.

Over 80% kept more of their paychecks after the tax cut changes were implemented earlier this year.

That figure includes most of NJ-03, and more than half of NJ-03 constituents claims the federal standard deduction which doubled from $12,000 to $24,000 under the new law which would become permanent if the Senate and White House sign off on the House’s new legislation. Approximately 48,000 constituents claim the child tax credit which went from $1,000 per child to $2,000.

“The bottom line is that a vast majority of taxpayers in South Jersey have, and will continue to pay less in federal taxes, and will continue to benefit from provisions in this bill that help with medical costs, assist with the costs of child care, and lessen the tax burden on small businesses,” concluded MacArthur.

_