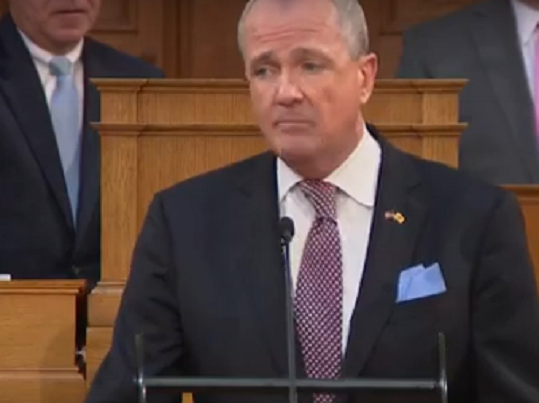

TRENTON, N.J. – Governor Phil Murphy’s Tuesday afternoon FY 2021 budget address went over like a lead balloon with leading New Jersey business organizations.

“A millionaires’ tax would be harmful to many small businesses even if the owners are not millionaires. It’s common for a business owner to sell their company as their retirement nest egg, throwing them into the millionaire’s category at a much higher rate,” said Eileen Kean, state director of NFIB in New Jersey. “Also, most small businesses are set up as pass-through companies in which the owner files business taxes on a personal tax return—that too could inadvertently subject them to a millionaires tax.”

–

“When New Jersey is already at rock bottom in the business tax climate rankings, and the Governor wants to raise taxes even higher and spend much more, it threatens the jobs of the 1.8 million people who work for small businesses in the state,” Kean added. “Gov. Murphy is essentially saying and has actually said in the past, if you don’t like it, move to another state. Losing a big part of the state tax base will hurt New Jersey’s economy.”

The Democrat Governor’s total budget ask is $40.9 billion.

Murphy’s proposals for new “revenues” extended beyond a larger millionaire’s tax proposal; he’s also demanding a higher cigarette sales tax, a health insurer fee and a “corporate responsibility fee.”

“The FY2021 budget address was more of the same from Governor Phil Murphy: proposed tax increases that will only make New Jersey increasingly less competitive,” complained Christina M. Renna, president & CEO, Chamber of Commerce Southern New Jersey in her own press release. “Regardless of what the Governor stated, the outmigration of wealth is real, as is the outmigration of college students who cannot afford to live here upon graduation. If we want to keep our educated future workforce in New Jersey, this is not the proper path forward. The only solution the Governor offers is a renewed call for a millionaires tax, which directly impacts residents and small businesses alike, instead of looking to addressing the tax incentives program, which will bring jobs and keep businesses in New Jersey. The CCSNJ looks forward to weighing in on the FY2021 proposal and offering suggestions that will make New Jersey more affordable for our businesses and residents.”

–