Liberalism is a byproduct of ignorance, Save Jerseyans.

Liberalism is a byproduct of ignorance, Save Jerseyans.

Sorry, Gaga fans, but I refuse to believe any liberal is “born” that way. No god could be so cruel! This is an environmentally-induced condition and, as luck would have it, there’s a tried-and-true cure. It’s called knowledge, folks, and we have it in abundant supply right here at your beloved Save Jersey blog.

Today’s lesson? Venture capitalism.

Few Americans know what “venture capitalism” means as a concept, nor do they appreciate what it means to our fragile national economy. According to the National Venture Capital Association, 11% of America’s private sector jobs are derived directly from venture capital-backed companies; the revenue derived from these companies accounts for roughly 21% of our country’s annual GDP.

How exactly do venture capital firms accomplish these impressive results?

Homework and hard work, Save Jerseyans…

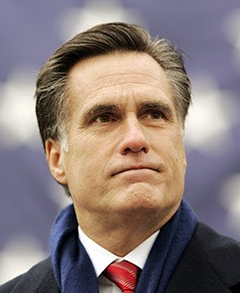

In short, companies like Mitt Romney’s unfairly-vilified Bain Capital invest in or “seed” small, start-up or under-capitalized companies with sufficient promise (and a solid business plan for profitability/growth). Usually these folks have exhausted their respective friend/family networks yet still need more money to get things rolling. In exchange for the venture capitalists’ investment, professional investors gain a significant ownership stake in the company itself and all of the control that goes along with their shares. Nothing is more American when you think about it! This process marries talented, motivated and hard-working dreamers without the funds to make dreams happen on their own with well-heeled and experienced investors willing to take substantial but calculated risks all for the chance of reaping above-average profits IF and when the target company ultimately succeeds.

Now you can see why the President’s attack on Romney’s Bain Capital tenure is so utterly infuriating.

Romney’s political adversaries have deliberately and duplicitously cherry-picked underwhelming examples from his extensive business history in order to make him look like a “vampire” or Gordon Gekko’s evil twin to impressionable swing voters.

Romney’s political adversaries have deliberately and duplicitously cherry-picked underwhelming examples from his extensive business history in order to make him look like a “vampire” or Gordon Gekko’s evil twin to impressionable swing voters.

The facts tell a radically different story. WSJ.com staff previously examined Romney’s Bain record and unearthed, in their own words, “big gains and some busts.” The list of Bain’s investments is impressive and reads like a “Who’s Who” of corporate America; they include, but are by no means limited to, giants such as Burger King, Staples, Burlington Coat Factory, Brookstone, Sports Authority, Domino’s Pizza and Clear Channel Communications. Just four of the companies saved by Romney and his company employ roughly 120,000 Americans today.

That’s 120,000 more jobs than Obama’s created/saved/invented over the past four years.

Yes, sometimes Romney’s sponsored businesses didn’t succeed, although often times the “end” came after Mitt was already gone and the investees ceased relying on Bain’s guidance. It’s also undeniable that the process of making an undercapitalized or generally-dysfunctional company profitable may involve temporarily tightening-up payroll expenses by laying off workers. It makes little sense to let payrolls bloat and permit EVERYONE to lose their jobs, right? Costs logically have to come in lower than revenues for profit to happen. Any company’s biggest expense is a human being. This is the old over-filled safety boat dynamic.

At least Mitt accomplished his long-term growth-oriented restructuring efforts with private capital. If you prefer the boat analogy, Romney and his partners were trying to locate and capitalize more, bigger and better safety boats for the American workforce! The Obama Administration undertook a superficially similar strategy in Detroit via the infamous auto industry bailout. The big difference? Obama threw workers over-board with (1) our tax dollars and (2) zero focus on long-term growth. Consider how General Government Motors employed 252,000 workers in 2008. After the bailout they had just 207,000, or about 45,000 fewer employees, with 131,000 of the current GM workforce laboring in foreign auto plants.

Numbers don’t lie. Campaigns are a different story!

So given all you’ve learned today about venture capital in the Romney context, Save Jerseyans, you can appreciate how this issue SHOULD be a winner for Mitt in November. Should. Unfortunately, you’re now a “one percenter” for having read this post start to finish. Not financially, of course, but in the knowledge department. Congratulations! You’re an intellectual millionaire.

Your follow-up mission: take this information to friends, family and coworkers skeptical of Mitt based on the misleading filth they’re hearing from Team Obama. Then, please take the opportunity to dig deeper into this topic. I’ve obviously only scratched the surface; we didn’t discuss the angel investor distinction or the difference between “A” and “B” round stages of investment. Interesting and important stuff for anyone “invested” in a strong America and determined to overcome the Obama Administration’s smear tactics!

A little extra enrichment? A case study from Mitt’s rapid response vid to Obama’s Bain attack ad:

httpv://www.youtube.com/watch?v=Q2w7iXazNso

Enjoyed examining this, very good stuff, appreciate it. "The hunger for love is much more difficult to remove than the hunger for bread." by Mother Theresa.

Just wish to say your article is as amazing. The clearness on your post is simply

great and that i can think you are a professional in this

subject. Well together with your permission let me to snatch your feed to keep updated with approaching

post. Thank you one million and please continue the rewarding work.