By The Staff | The Save Jersey Blog

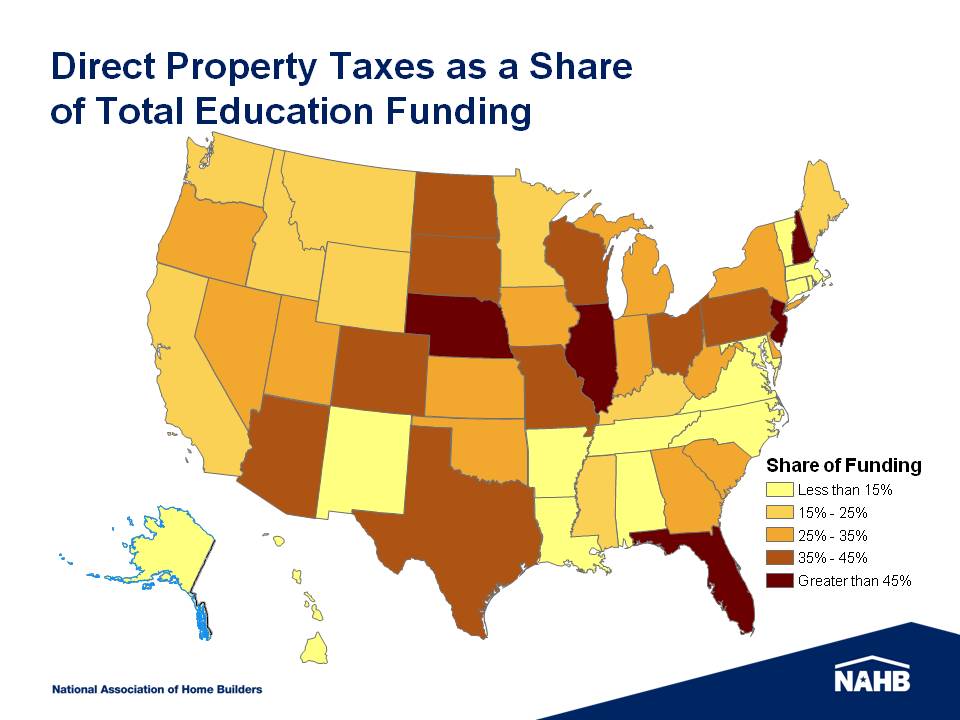

New Jersey’s property taxes are the highest in the nation largely due to the fact that this is one of the few American states to rely heavily on property taxes to fund K-12 education:

Recently, the NJ Citizens for Property Tax Reform began a formal push to make either the sales or state income tax, not the property tax, the new primary source for New Jersey education funding. Sales and/or income taxes would rise but property tax bills could drop initially by 35% and ultimately anywhere between 50% and 60%. Other elements of the proposal include a two-year freeze tax freeze and a 2% cap on prospective tax increases without local voters’ approval.

What do you think, Save Jerseyans:

Should New Jersey adopt the N.J. Citizens’ plan? Or should we stick with property taxes and focus instead on reform including cutting waste, pension reform, school choice, ending PILOT abuse and adopting a new funding formula?

_______

There is only one other state that percentage wise relies more on property taxes for public school funding than does NJ

Should be entirely funded by LOCAL property taxes. Funneling money to the state via the sales and income tax so it can then choose how to redistribute it to local school districts is ridiculous.

Impossible to use sales tax !! Whoever started this is a quack!!

And like the douchebag you truly are, you never tell us which state that is…

You are truly and deservedly f****d, Nueva Yersey.

Sounds like we raise the sales or income tax now and hope for a property tax reduction down the road…been down that road …doesn’t work and we get screwed.