By Rosemary Becchi

__

New Jersey should be the land of opportunity for families, businesses, and individuals looking to pursue their own version of the American Dream. Standing in the shadow of Lady Liberty, New Jersey should offer everything an individual could want — good schools, thriving businesses, beautiful farmland, big city excitement, small-town history, the Jersey Shore, casinos in Atlantic City, and last but most certainly not least — the great people of New Jersey. But for generations now, the people of New Jersey have been robbed of what the state should have come to offer.

The unfortunate truth is that Trenton has consistently passed the buck and allowed New Jersey to become grossly over taxed. The people of New Jersey are now on the verge of even higher taxes, which will, without question, drive away new enterprises and force existing businesses to either go out of business or relocate out of state. Jobs do not come to places where taxes are too high and regulation is too burdensome.

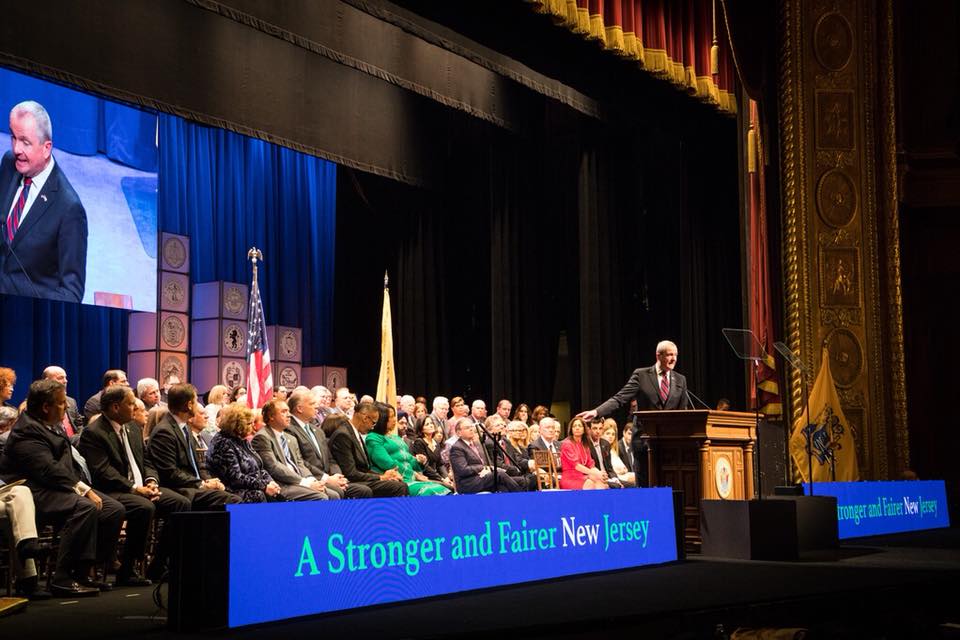

Governor Phil Murphy believes that “planting your flag” in New Jersey will be the smartest decision you’ll ever make. It should be — but the problem is that at some point the cost becomes so high that it becomes a bad decision. Based on the inauguration speech we all saw, business as usual has gotten even worse. Clearly, Trenton has no qualms about raising taxes yet again and taking even more of our hard-earned money. How much more do the people of New Jersey need to be taxed in order for Trenton to find a solution to the exodus of people and businesses, who are fleeing the state towards better opportunities elsewhere? How much in taxes is needed to bring about what Governor Murphy sees as a state that industries can grow and communities can rise? What Trenton fails to understand is that it will never be enough because you can’t tax your way out of this problem.

A stronger and fairer New Jersey starts with transparency and honesty out of Trenton. Remember the saying, “Trenton Makes, the World Takes!”? Well, for far too long it has been “Trenton takes and just keeps on taking.” In survey after survey, New Jersey is consistently ranked as one of the worst states for businesses. While our workforce and access to resources rank high, our corporate, sales, individual and property taxes constantly weigh us down.

Robust job creation requires businesses both large and small to believe the economic climate is stable and trending away from higher taxes and added regulation. Much like the financial markets, job creation comes from forward thinking and positive outlooks. Put simply, jobs are created when employers believe their profits can and will be available to invest in bonuses, training, or business expansion. Lowering the rates on American businesses will put more money into the hands of businesses, so they can re-invest that money in the people, equipment, and technology that will allow their businesses to grow. Lowering taxes will make New Jersey, once again, competitive around the world.

Pessimists believe the new federal tax cuts will create an economic disaster. But what have we actually seen? Bonuses, job creation, and a financial market that is consistently growing. Upon the President signing the tax bill, companies across the United States have already started to take action. Just last week, Apple announced that it will bring back $252 billion dollars in cash from overseas and pay $38 billion in taxes on profits made overseas. In addition, Apple will make $30 billion in capital expenditures in the U.S. over the next five years — this includes opening a new U.S. campus and creating over 20,000 new jobs.

Other companies, such as Nationwide Mutual Insurance, Aflac, SunTrust Banks, and Visa, have all recently announced increases to their matches for employee 401(k)s in response to the new tax law. Additionally, companies such as BB&T, Capitol One, Fiat Chrysler, and Walmart have announced plans to hire more workers and are taking steps to increase base pay, provide bonuses, and expand maternity and parental leave.

Governor Murphy’s inauguration speech wasn’t about finding ways to improve New Jersey. He repeated a tired, phony political narrative to lay the blame for New Jersey’s failures at Washington’s feet. If the new tax law is lowering taxes and helping citizens in other states, one has to stop and wonder how our state government has managed to turn what has been a positive for others into a negative here at home.

It’s beyond time to stand up and start demanding solutions to our economic problems. Good economic policy must be developed, and most importantly, adopted. It is time to stop the political gamesmanship and “passing-the-buck rhetoric.” and take responsibility for our home, for New Jersey. We want companies such as Amazon and Apple to build their new campuses in New Jersey. That means we have to stop talking about raising taxes and start talking about lowering taxes across the board.

We can do better. We can do much better. Let’s take the shackles off of New Jersey families, businesses, and our economy and get to work in implementing policies that will lower our taxes, create jobs, and attract new business. Let’s make New Jersey the beacon of opportunity we all know it can and should be.

__

Rosemary Becchi is a tax attorney who formerly served as counsel to the majority staff of the U.S. Senate Finance Committee. She is currently a partner with the law firm of McGuireWoods LLP and a resident of Short Hills, N.J.

__