By Matt Rooney

_

The chickens are coming home to roost in Jersey City, folks.

It was predictable. After many years of “payment in lieu to taxes” abuse — the policy which allowed the populous North Jersey urban center to revitalize itself, rapidly, at the expense of suburban taxpayers — have resulted in a sudden leap in property tax burdens for middle class Jersey City homeowners. One homeowner is reportedly seeing a $20,000 ANNUAL increase in his bill. In one neighborhood? The average increase: 75%!

Why would anyone be surprised? It’s the first Jersey City reval since 1988. I was four years old when Jersey City last did something which should happen on the regular.

So yeah, Jersey City is getting what it voted for. I take no pleasure in pointing that out.

The key now is making sure that this NEVER happens again.

There’s never any substitute in a democracy for making better decisions at the voting booth, but one New Jersey legislator has an idea.

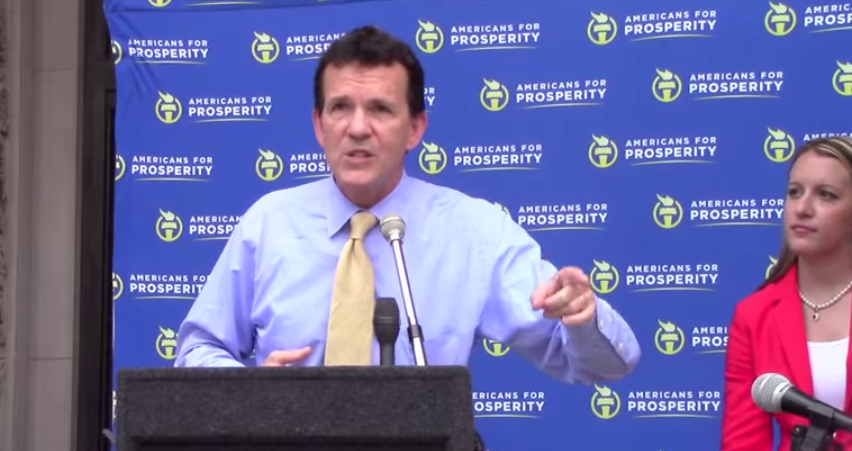

State Senator Declan O’Scanlon (R-Monmouth) is the sponsor of S-2029, legislation which would, according to his office, “require assessors to perform annual reassessments on 100 percent of properties, maintaining assessments at current market value.” O’Scanlon also wants municipalities to be provided with “computer assisted mass appraisal software” to aid in the implementation of these regular revals.

“The bottom line is that the system that we have currently instituted in Monmouth County is the result of the best practices existing in 49 other states,” said O’Scanlon. “This is the least expensive way to assess valuations and the most consistent way to ensure that taxpayers are treated fairly relative to their neighbors. It costs the State an estimated $175 million every ten years when we do revaluations, in addition to the millions in budgetary shortfalls from residents appealing inaccurate assessments.”

It’s an uncontroversial idea, one which would address *most* under- and over-valuation issues overnight.

It’d also begin to address the unfair redistribution of wealth from New Jersey’s over-taxed suburbs to our urban centers where, in places like Camden at the other end of the Turnpike, non-residents are already paying MOST of the bills.

So why hasn’t the Senate Community and Urban Affairs Committee moved on it yet?

Electoral politics. Pure and simple. The people who rely on these cities for their vote margins will never, ever, bite the hand that feeds them, even if the rest of the state goes under in the process.

O’Scanlon’s idea isn’t theoretical, by the way; his Republican-controlled county is already having success with his idea.

“Four years ago, Monmouth County implemented the Real Assessment Demonstration Program,” said O’Scanlon. “We learned a number of lessons along the way in our effort to achieve a fairer and more accurate system to assess properties. I’ve taken those lessons into account and incorporated what works into this new legislation.”

“With this initiative, we can eliminate the massive cost for towns to complete wholesale reassessments every 10 years,” added O’Scanlon. “This will also protect homeowners from the tax shock that many currently receive when their home is reassessed for the first time in a decade or more. Nobody should risk losing their home because their tax bill changed massively to account for years of accumulated value discrepancies.”

–