It’s Tax Day again, Save Jerseyans, which means it’s time to tell you what you already know…

The American Legislative Exchange Council (ALEC) dropped its 15th annual Rich States, Poor States: ALEC-Laffer State Economic Competitiveness Index report co-authored by the legendary Dr. Arthur Laffer, FreedomWorks economist Stephen Moore, and ALEC Chief Economist Jonathan Williams.

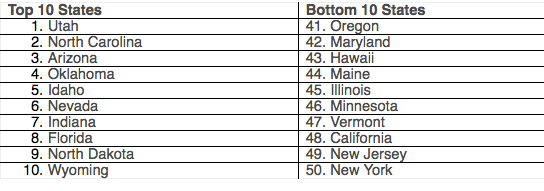

The report – which looks at 15 “economic policy variables” – finds New Jersey in the 49th position, wedged between uber-expensive New York (#50) and the failed state of California (#48):

Unsurprisingly, the Census Bureau reported at the end of 2021 that New Jersey lost more population than 42 other states between July 2020 and July 2021 during some of the ugliest days of the Covid-19 pandemic-related government restrictions.

Were lockdowns, remote learning and mandatory masking the final straw for some mask-wearing residents happy to work remotely from freer, cheaper states?

“Americans continue to vote with their feet toward states that have lower tax burdens and value economic competitiveness,” said Williams. “Rich States, Poor States teaches us that states with lower taxes, especially those that avoid personal income taxes, have seen significantly better rates of in-migration than states with high income tax rates.”

“If you believe incentives matter, and I do, state policies have the effect of changing those incentives at both the state and local levels,” added Laffer. “Those changes in incentives have consequences. This ranking of states is a tried-and-true formula. I think it is a great way of picking winners and giving guidance on how states should be effectively governed.”