There’s no better resource on the web for public policy research than The Heritage Foundation, Save Jerseyans.

There’s no better resource on the web for public policy research than The Heritage Foundation, Save Jerseyans.

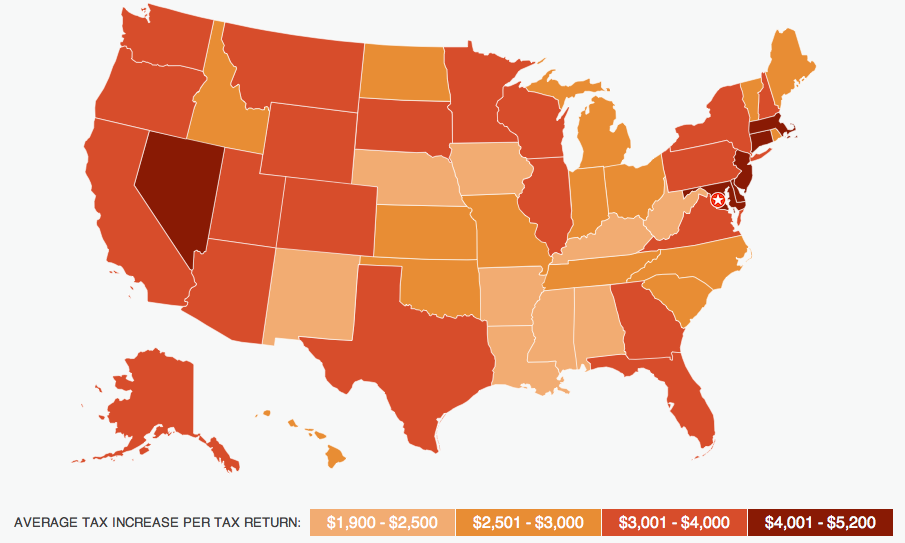

Lately, they’ve put a ton of time into analyzing the impact of “Taxmageddon,” the name popularly assigned to January 1, 2013 when many of the ObamaCare-related tax hikes go into full force and effect… conveniently after the presidential election!

The nationwide stats are staggering. For example, the average increase on America’s 33.1 Million baby boomer filers will be $4,223 per return. Families are looking at a $4,138 hike, or almost 6% of their average annual income.

Few states will be harder hit than New Jersey since our per tax return average income is relatively high: $79,151. That’s an average increase of $4,216 for every return filed…

Heritage’s scholars did the math, and they estimate a $19.308 Billion tax increase for the Garden State. Heritage even broke down the total tax increase by Congressional district (based on the current, pre-redistricting map) utilizing 2006 and 2008 IRS data by zip code.

The hardest hit New Jersey districts?

- NJ-5 (Garrett): $2,202,462,797 ($6,253 avg. increase per return)

- NJ-7 (Lance): $2,158,522,854 ($6,090 avg. increase per return)

- NJ-11 (Frelinghuysen) $2,531,951,099 ($6,960 avg. increase per return)

- NJ-12 (Holt) $2,039,900,666 ($5,639 avg. increase per return)

I’ve bolded Rush Holt’s name and ObamaCare district stats because he’s the only one of those four congressmen who actually voted for the Affordable Care Act!

The least-hard hit districts in New Jersey? A pattern is emerging:

- NJ-13 (Sires) $874,564,619 ($2,575 avg. increase per return)

- NJ-10 (Vacant) $727,325,730 ($2,357 avg increase per return)