New Jersey’s economic woes (specifically its 9.8% unemployment rate) are really pretty simple to explain, Save Jerseyans:

New Jersey’s economic woes (specifically its 9.8% unemployment rate) are really pretty simple to explain, Save Jerseyans:

- New Jersey is still too expensive because we still tax too much.

- We still tax too much because we still spend too much.

- The national/global economies happen to still stink.

The equally simple follow-up question is “who bears the responsibility?”

Save Jersey‘s contributors have expended a ton of digital ink criticizing Trenton Republicans for a lack of ambition in the spending reduction department. But at the end of the day, no one (with half a brain) who voted for Chris Christie in November 2009 thought that he could truly “save” our state without also eventually catalyzing a change in the ideological composition of the state legislature…

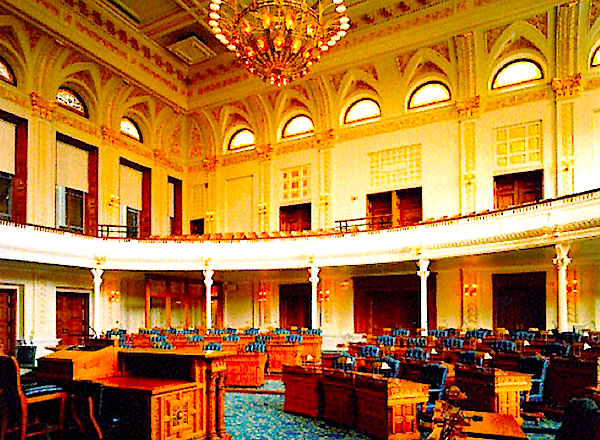

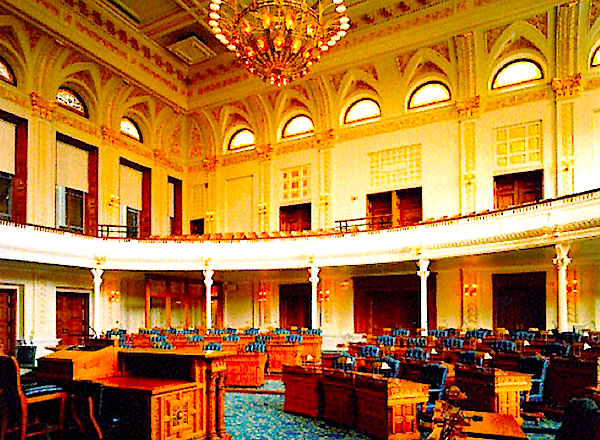

New Jersey has a “powerful” governor model, but he still can’t lighten our tax burden without the cooperation of the other political branch of state government. And the bad news? A healthy cocktail of unfavorable variables conspired at redistricting time to make that lift nearly impossible barring a major Republican landslide or a once-in-a-generation political “realignment” before the legislative map is redrawn again… in January 2021.

Yes, Governor Christie has used his formidable political skills to stay the bleeding; a property cap tax here, some regulatory changes there, etc. and so on. What he cannot change is the fact that Democrats ruled Trenton for nearly a full decade before his arrival (actually longer if you consider Christine Todd Whitman to be a Democrat like I do, Save Jerseyans). They passed well over 100 different tax increases in the eight year immediately preceeding the Christie Administration. The predictable end result? We cite the stats here nearly every day; New Jersey is tied for dubious honor of “the second most-taxed state in America.”

This is still a free country. Intra-national travel is a fundamental right. No free individual (human or corporate) is required to stay in New Jersey. That’s one of the fatal flaws of liberal economic theory! When life gets too expensive, those who can will move to more hospitable locales. In fact, I’ve yet to meet the person who says he or she is leaving the Garden State due to (1) “budget cuts,” (2) “too many social programs,” (3) “inadequate public employee benefits,” or (5) “insufficient public funding for abortion.” New Jerseyans retire to North Carolina, and businesses move their offices across the Delaware River to Pennsylvania, because they’d be stupid to trade their own family’s prosperity for Trenton’s self-serving largesse.

So the “why” and “who” inquires into New Jersey’s economic decline aren’t very hard to deduce. Neither is the only available solution (short of moving away ourselves): electing a legislature that is devoted to making New Jersey less expensive. The real challenge for those of us who get it will be motivating those who don’t. It always is. But there’s no other way.

In the late 1980s there were many NYC companies looking to move to NJ as the NYC operating expenses were high compared to NJ. Governor Jim Florio and the Democrat legislature raised business taxes enough in 1990 to make NYC look like economic nirvana in comparison to NJ. Here is a simple solution to business tax policy-return to the 1989 taxes and rates. Then abolish all taxes levied since 1989. Suddenly PA will not look that enticing and NYC will be the NYC of old-"I'm outta here!".

How about all this profligate spending on lame resorts like Revel, solar industry bailouts, and Xanadu – the boondoggle that just won't die?

Wrecking our credit for cronies.