Save Jerseyans: I know there is consternation in New Jersey over the proposed Republican tax plan (the numerous versions of which will eventually go through a reconciliation process).

While I think the tax plan is far from perfect, it’s a slight improvement over what we have now because it actually makes the tax code fairer by reducing deductions and flattening the rates a little, and it drastically cuts the corporate tax rate making us more competitive for future jobs.

Of course I still think this plan is far too complicated and could have been simplified with zero non-standard deductions, much higher standard deductions for individuals and families, and only two to three tax brackets at the most with lower rates. But at least it’s a step in the right direction. I also would like to see drastic cuts to the budget occur too but unfortunately with the current leadership, pigs may fly before that happens.

None of that feels good to some New Jersey upper middle class residents who may see their taxes go up slightly. I understand that and I really am loathe to accept it. Let’s not forget: New Jersey is considered a wealthy state according to our progressive tax code so, without deductions, especially the current full SALT (State and Local Taxes) deductions, we will get hit harder than say Iowa, though still net out ahead for all residents in the short and long term with this new tax plan (some say 92% of New Jersey residents may get tax cuts but until a final plan is established we won’t know for certain).

Let’s think big picture here.

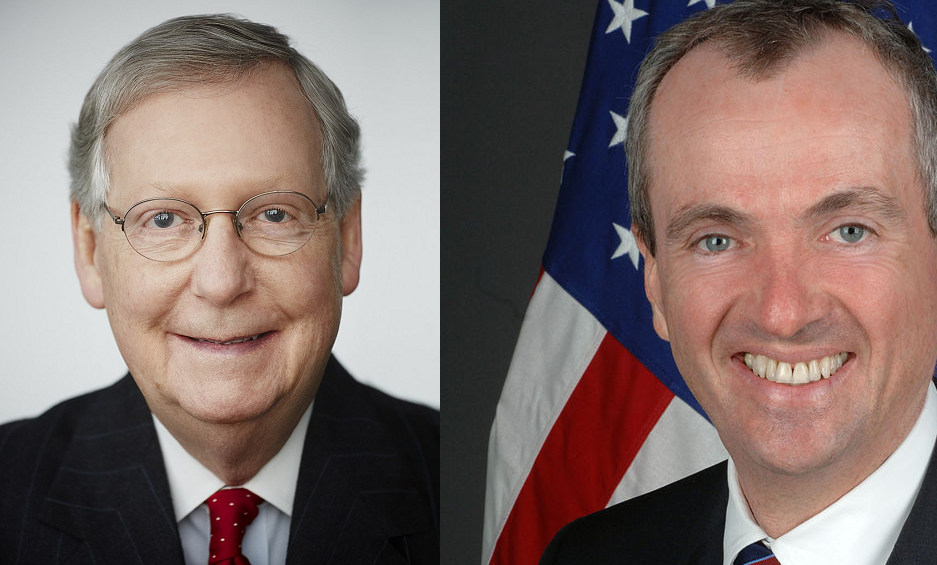

We now have Governor-Elect Murphy who has promised to raise spending far more than the revenue he wants to raise. Not only is that unrealistic, but it’s actually impossible since New Jersey has a constitutional balanced budget amendment. So the only way he can deliver is by drastically raising taxes, borrowing us into oblivion (with further credit downgrades), or not living up to his promises. With the new tax plan, he’s going to find it a lot harder to do the first even though that will be his first course of action, even with a Democratic legislature. He could very well alienate the middle class liberals, those of which he said he had their backs. We know the tax and spend progressives use the mantra of taxing only the uber-wealthy, but when push comes to shove, they spread the taxes to everyone that pays them and give more handouts to people who pay little to none.

Could the Republican tax plan actually provide a benefit and make Murphy’s strategy more untenable, even in a blue state like New Jersey? My instincts tell me yes.

And the exit polls from this last election confirm that. The number one issue for voters was a close tie between property taxes and government corruption. The Republicans just made an inferior case this cycle to the people of why we are the party of affordability and anti-corruption because Murphy claimed he was the champion of the middle class and Chris Christie was an unpopular governor who people felt was corrupt (i.e. Bridgegate). I know you’re going to tell me that the Lieutenant Governor used property taxes as an issue this cycle. And she did in a way, but only to propose a weak, recycled Illinois Democratic idea she dubbed the “Circuit Breaker.” It was a poor plan that people didn’t really understand and it was only a band-aid solution. Instead of proposing things like the “Circuit Breaker,” the current tax plan should give Republicans a leg upon which to stand in the push for real reforms (I detailed some of these ideas in a prior article) and once again champion the middle class if they played their cards the right way.

And I understand, Save Jerseyans, that’s a big “if” considering the state of the New Jersey GOP.

This reform effort could nevertheless be an albatross for Murphy as people see red states getting decent cuts to their taxes compared to their blue state counterparts. And it pushes us closer to a flatter, less socially engineered tax code. I personally would favor taxing purchases, not income, but we can’t deny that a flat tax with no deductions and a lower rate would be a far better option that what we have. And lowering the federal corporate rate gets us closer to a 0% rate, which is what corporate taxes should ultimately be, especially on small businesses who aren’t privy to the same tax shelters as politicians’ favorite donors from crony mega corporations.

I know I’m speaking to a chorus of crickets in Trenton when it comes to our Democratic representation, but the best way for the Democratic caucus to retain power, if the Republican tax plan goes through, is to find a way to cut middle class property and income taxes, such as reforming the school funding formula. Otherwise, you’ll be giving smart Republicans in the state an issue to beat you over the head with in 2021. And don’t worry Save Jerseyans: we have a few smart Republicans inside and outside of Trenton, even if it sometimes feel we don’t.

–