TRENTON, N.J. – That’s right. Get ready, Save Jerseyans.

While you were ordered to stay at home by Governor Murphy (unless you’re rioting or protesting something other than the lockdown), Trenton agencies voted to raise tolls on the Garden State Parkway, New Jersey Turnpike and Atlantic City Expressway. The average increase adopted without public in-person participation? 33%.

–

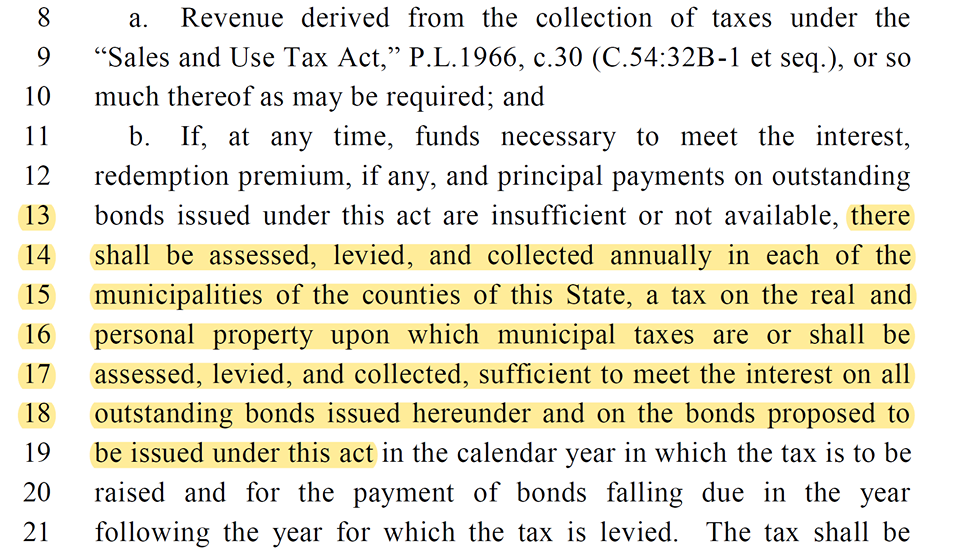

Next up: on Thursday, the New Jersey Assembly will vote on an illegal $5 billion borrowing plan backed by Governor Phil Murphy. Hidden in the borrowing proposal (A4175) is a property tax surchage provision to pay for the new debt:

–

–

Assembly Speaker Craig Coughlin says the plan is “not ideal.”

No shit, Craig.

Our state’s average property tax bill was $8,953 last year, the highest in the nation. Compounding the property tax burden as the coronavirus lockdown-battered economy flounders is profoundly idiotic. Tax collections are cratering because of a self-inflicted wound (the unnecessarily endless stay-at-home order which remains in place despite the fact that the curve is flat).

Oh… and the sales tax (collections for which are down 13.7% compared to April 2019) is probably going to get worse, something I’ve been predicting for awhile.

The way it works: “Revenue derived from the collection of taxes under the “Sales and Use Tax Act,” P.L.1966, c.30 (C.54:32B-1 et seq.), or so much thereof as may be required” will be applied to bond interest and principal payments, but if salles tax revenues don’t suffice, then “there shall be assessed, levied, and collected annually in each of the municipalities of the counties of this State, a tax on the real and personal property upon which municipal taxes are or shall be assessed, levied, and collected, sufficient to meet the interest on all outstanding bonds issued hereunder and on the bonds proposed to be issued under this act in the calendar year in which the tax is to be raised and for the payment of bonds falling due in the year following the year for which the tax is levied.”

The way it works: “Revenue derived from the collection of taxes under the “Sales and Use Tax Act,” P.L.1966, c.30 (C.54:32B-1 et seq.), or so much thereof as may be required” will be applied to bond interest and principal payments, but if salles tax revenues don’t suffice, then “there shall be assessed, levied, and collected annually in each of the municipalities of the counties of this State, a tax on the real and personal property upon which municipal taxes are or shall be assessed, levied, and collected, sufficient to meet the interest on all outstanding bonds issued hereunder and on the bonds proposed to be issued under this act in the calendar year in which the tax is to be raised and for the payment of bonds falling due in the year following the year for which the tax is levied.”

So yeah… we’re screwed.

“After mandating people to give up their businesses and their jobs, this bill adds insult to injury by making them pay for the loss of revenue that resulted from the government imposed lockdown,” Assemblyman Gerry Scharfenberger (R-13) complained on Wednesday, the eve of the Assembly vote. “Raising the sales tax, and adding a surcharge to New Jersey’s already highest in the nation property taxes, will be a devastating and quite frankly, a financial death blow to countless people and families.”

The Thursday, June 4th hearing (11:00 a.m. EST) will be virtual.

In other words: you’re not invited to attend. Only to pay.

Click here to identify and then contact your legislators.

–