On January 24, the New Jersey Board of Public Utilities approved two massive offshore wind projects: 2,400 MW Leading Light Wind and 1,342 MW Attentive Energy Two. According to the BPU, the two projects will raise the cost of electricity by “only” $6.84 per month for a typical residential customer, $58.73 for a typical commercial customer, and $513.22 per month for a typical industrial customer. These figures are all in 2023 dollars, so when inflation comes into play – the contract prices will be raised automatically, costing ratepayers even more money.

Those higher monthly costs may not sound like much, but when you add up the costs for all 3.7 million residential customers, 538,000 commercial ones, and over 11,000 industrial customers, the annual bill totals over $750 million. By the time the projects are completed, inflation is likely to have pushed that figure close to $1 billion – every year, for the 20-year life of the contracts.

According to the BPU’s “Fact Sheet,” the two projects will create 5,128 direct full-time equivalent job-years (one job-year is economist speak for one full-time equivalent job for one year) during the first ten years of operation. So, $750 million/year for ten years is $7.5 billion more that New Jersey electric customers will be forced to pay to create 5,128 job-years. That amounts to about $1.5 million per job-year. In other words, New Jersey electric ratepayers will be forced to pay $1.5 million for each full-time equivalent job created every year.

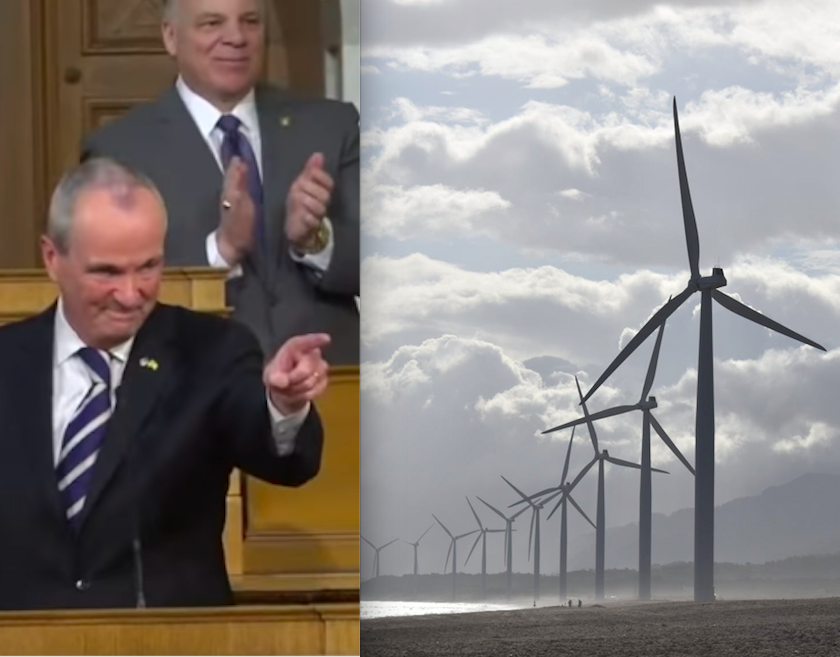

The BPU press release quotes Tim Sullivan, who heads the state Economic Development Agency, saying, “Offshore wind is a once-in-a-generation opportunity to invest in our long-term economic growth and sustainability, and it has already started to create good-paying, family-sustaining jobs across South Jersey. The future of offshore wind is bright and it’s critical New Jersey remains at the forefront.”

According to my own research on the impacts of higher electric prices on jobs, each $1 million increase in electricity costs leads to a loss of around six direct job-years. Hence, $7.5 billion in higher electricity costs will lead to a reduction of 45,000 jobs, a loss of about nine jobs for every job that supposedly will be created by the two projects.

Apparently, Mr. Sullivan’s Alice in Wonderland view of economic growth believes that losing nine jobs to create one is a good deal for the New Jersey economy and its residents. Perhaps when he claims offshore wind is a “once-in-a-generation opportunity,” he means the gains to Governor Murphy’s well-connected friends.