By Joe Sinagra | The Save Jersey Blog

Democrat Governor Jim Florio was the first to use the pension fund as a fall-back piggy bank in a time of crisis, Save Jerseyans.

Democrat Governor Jim Florio was the first to use the pension fund as a fall-back piggy bank in a time of crisis, Save Jerseyans.

In 1992, facing a budget shortfall, Florio pushed through the Pension Revaluation Act with unanimous support in the legislature, reducing taxpayer contributions to the public retirement plans by $1.5 billion.

This scheme was accomplished through the financial deception of introducing a more optimistic method of evaluating pension system investments. The end result was to make the retirement plans’ finances “look far rosier” than they really were, by lifting the projected rate of return on the fund’s investments to 8.75% from 7%.

In 1997, New Jersey sold $2.75 billion of bonds paying 7.6% interest, putting the proceeds into the pension fund to be invested for higher returns. Unfortunately, the fund has earned less than 6% annually since the bonds were issued.

Christie Todd Whitman, running on a tax-cutting platform, defeated Florio in the 1993 governor’s race. To help pay for her promised tax cuts, Whitman, like her predecessor, turned to the pension fund. Governor Whitman invested the pensions into the stock market, and no one complained when the funds were making money. She left in 2000 and the funds continued to do well with annual investment returns of 8.75 percent until the dot.com bust of 2001 when the markets took a massive dive.

After Christie Todd Whitman, accumulated pension debt was compounded by those following her tenure. Governors DiFrancesco, McGreevy, and Codey continued the trend and the public was lulled into a sense of false financial security. Unknown and unannounced to the public, monies were indiscriminately withdrawn from the pension funds and used to pay for tax cuts and balancing the state budget. Out on the campaign trail, politicians touted the virtues of how through their financial genius they were able to balance their state and local budgets, all the while relying on returns from the stock market to cover the missing funds.

It was the Whitman administration that suggested towns set contributions aside for when the state called to make good on them. The small print in Whitman’s bill was ignored which stated that funds the state failed to contribute would have to be made up at a later date.

And, even as pension contributions were neglected, New Jersey politicians sweetened the pot. In 2001, government employees and teachers benefits were increased by 9%, creating an additional $4.2 billion in liabilities. In 1999, the state approved a “20 and out” measure that allowed firefighters and local police to collect pensions equal to 50% of their pay after 20 years of service . . . a perk formerly reserved only to the state police. Benefits added since 1999 have increased liabilities into the billions.

Governor James McGreevey appointed a money manager as head of the State Investment Council, a position which would set policy for the pension plan, and some of the fund’s assets were turned over to Wall Street professionals to diversify into alternative investments such as hedge funds and private equity.

Politicians remained silent as pension funds dwindled. To bring what was happening to light at that juncture would certainly mean political suicide, it was reasoned, knowing that towns and municipalities would have to raise taxes to make up for their error in financial judgment and planning.

By the time Governor Corzine came into office, it was too late to turn back the clock as he put the brakes on, stopping the practice. To his credit, Corzine had imposed reduced benefits on state workers, raised the retirement age to 62, increased the salary requirement for pension eligibility, increased employee contributions, and capped pension income. But by then, the damage was done.

The misery of New Jersey’s pension woes can’t all be blamed on poor investment results. For years, New Jersey shortchanged the retirement programs that cover teachers, police, and other public employees, as the stock market plunge wiped out billions of dollars, the real problem has been the underfunding. Those members contributed in good faith towards their pensions and they aren’t the problem.

The problem? Politicians who continued to raid the pension system and not replenish what was taken.

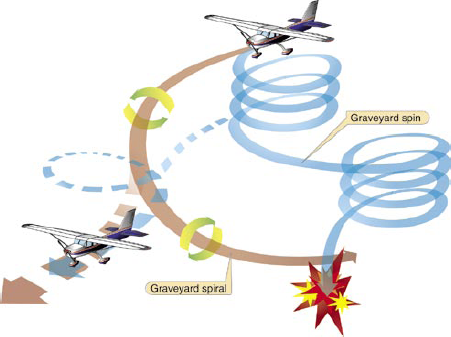

Having a negative cash flow with contributions that are less than the benefits paid out leaves the state on the fast track to an out of control death spiral.

Florio, Whitman, it doesn’t matter anymore who gets the fickle finger of fate, Save Jerseyans; it is time to go forward, not backwards. What’s done is done.

Moody’s ranked New Jersey’s pension plans as having the fourth highest unfunded liabilities in the nation. A collapse could come as soon at 2018,. and current New Jersey Governor Chris Christie had no influence at all on Moody’s rating.

Christie is going to be made out to be the bad guy, and the somber mood at Tuesday’s budget address was proof enough that I’m right, but he needs to come up with a pension reform plan to correct decades of mismanagement from both parties. Democrats will make him the scapegoat or the fall guy for the failure of their party to do something when they had the chance. They kicked the proverbial can down the road and now look to place the blame on anyone but themselves.

We’re the ones who will pay for their mistakes. By 2018, state taxpayers will begin paying more than $5 billion per year for pensions, about 10 times higher than the current payments being made, more than the current total state and local spending in Vermont, Wyoming and both Dakotas, respectively.

Unless there is pension reform, Save Jerseyans, regardless of who is assigned the blame or fault, the taxpayers will suffer and the pensions will dwindle until there is nothing left.

If you think New Jersey’s taxes are high now, you ain’t seen nothing yet.

I say, run the pension fund into the ground and let the public unions take it up the back chimney. When their pimps gave taxpayers the finger salute by wringing gold-plated salaries and perks that are unsustainable in the long run, they should have seen it coming.

I asked the Governor at a town hall if he would consider moving new employees to the Alternate Benefit Program, a 401K type program currently used by higher education. He said that he could not do that as he needed the current cash contributions to fund the pension liabilities. Yesterday the media posted the 1700 former public employees receiving at least $100K pensions. Very few higher eds were included as they are under ABP. That system works with no long term liability to the taxpayers. If the current defined benefit plans run out of money, they run out. As the funds dry up adjustments will be made. It will be like having your unemployment run out, You learn to live without it and go on.

At the time of Florio and Whitman there was over $100 billion in the police and fireman pension PFRS. Money paid in by members, enough if left alone would have self funded members that paid into it. All administrations following pilfered those funds and the state reneged on their promise to pay it back.

If you change the rules on those that paid into it after the fact, the very least the state should have replaced their money as promised before going forth and negotiating any changes. Those like the police and fireman who paid their money into their self funded pensions aren’t to blame for the woes of todays pension problems.

Your advise is ridiculous. What do you think would happen to taxes if the pension system folded. Police, Firemen, Teachers etc do not get rich in their fields and a pension was part of the deal when you take a public service job. We all make career choices in life you are obviously not happy with yours. How about this, next time your house getting robbed call your doctor. Even better if you see a building on fire call an oil company executive.

Can’t say for firemen – we have a volunteer brigade here – but police and teachers do get rich at the taxpayer’s expense. You’ve bribed the legislature and the municipalities into soaking the taxpayer but guess what, math always wins. You have a problem with crime? Privatize police and let people carry.

You Tell “Em Joe. Terrific Background Information.

I always hear about what was promised when it comes to State pensions….How much was promised? 10 years of pension, 15 years of pension, 20 years of pension? No one can define what was promised.

How much health care was promised? 10k a year in premiums? 15k a year in premiums? Can anyone define what premium contribution were promised? Nope, you can’t because nobody knows what premiums will rise to or how fast.

How is it that One Side can demand the rules of the game remain constant, but the taxpayers are expected to absorb all changes in circumstance……life expectancies, insurance premium amounts, recessions…..

Doesn’t that seem a little unfair…. and more importantly for people counting on a pension….. Unsustainable.

Thank You Cheryl!

For 36 years I adjusted to changes that weren’t there when I signed up. Those changes were always MORE; more work for no more money was the main one, followed by more work rules that tougher unions than ours usually got a perk for allowing. We saw what had to done, and did it. Now that we’re done and gone who cares what we did. Who cares what the deal was we were promised. I get health care and 1800 a month, Craig. I guess I’m unsustainable. Why not just choke me with a free condom or some other very important government supply.

This article is basically factual. But what the article does not mention is that state workers have been the only one contributing to the fund for most of 20 years. It is our money that the politicians have used and abused. And we should not have to pay additional for the abuse of others. The people living in the state as a whole benefited from what the politician did for years and so the people in the state should have to pay to fix it. If it means higher taxes, so be it. What Christie wants to do is make state workers pay more and more. We already have had a hefty increase and there is no end to more increases in the name of fixing the system that we have only contributed too! Why should it only be the state workers that pay and pay, every time there is a budget problem. Three years ago, we had mandatory furloughs, 14 days of them, with no pay to fix the budget. I am sick of paying up. It’s the state job to ‘man up’ and at least attempt to fix this dire situation. Also, Christie made a promise which he is reneging on big time. Shame on him!!!!!!

Thank you Jim for your radio show that I listen every morning on my way to work. I am retired military and prior to moving back to NJ my late father told me about the tax woes of NJ way back in the 1990’s The damage is done. I would like to see past politicians who created this mess liable for their bad decisions. That is what we do in the military. Unfortunately that will not happen, and us workers will be left to pick up the pieces. That bad thing is that we will bicker and argue amongst ourselves on how to solve this problem and the politicians who created the problems are long gone and living comfortably. Keep up with you radio show. It gets me through my day.

Rudy

What of all the taxpayers that used the system for 30 years when they lived in those towns and now have moved out how can the state get back that money that those taxpayers extracted from the pension fund .and still owe .has the stet no recourse or do they go after the new young taxpayer and burden them who just moved here ? I would recomend under these circumstances that the younger generation of workers avoid living here and paying for all the past mistakes that were made .

Nothing will change. The only thing left to do is leave NJ and take your tax dollars with you.

Essex county 0 change.

Union County GOP swept out in Summit and Kenilworth. Cranford and Springfield just voted out incumbents as their tradition every election. Lesniak’s B of Ed people win in Elizabeth. GOP sweeps in Garwood and regains 5th Ward in Roselle Park. GOP picked up a seat in Winfield by 2 votes!